how does doordash report to irs

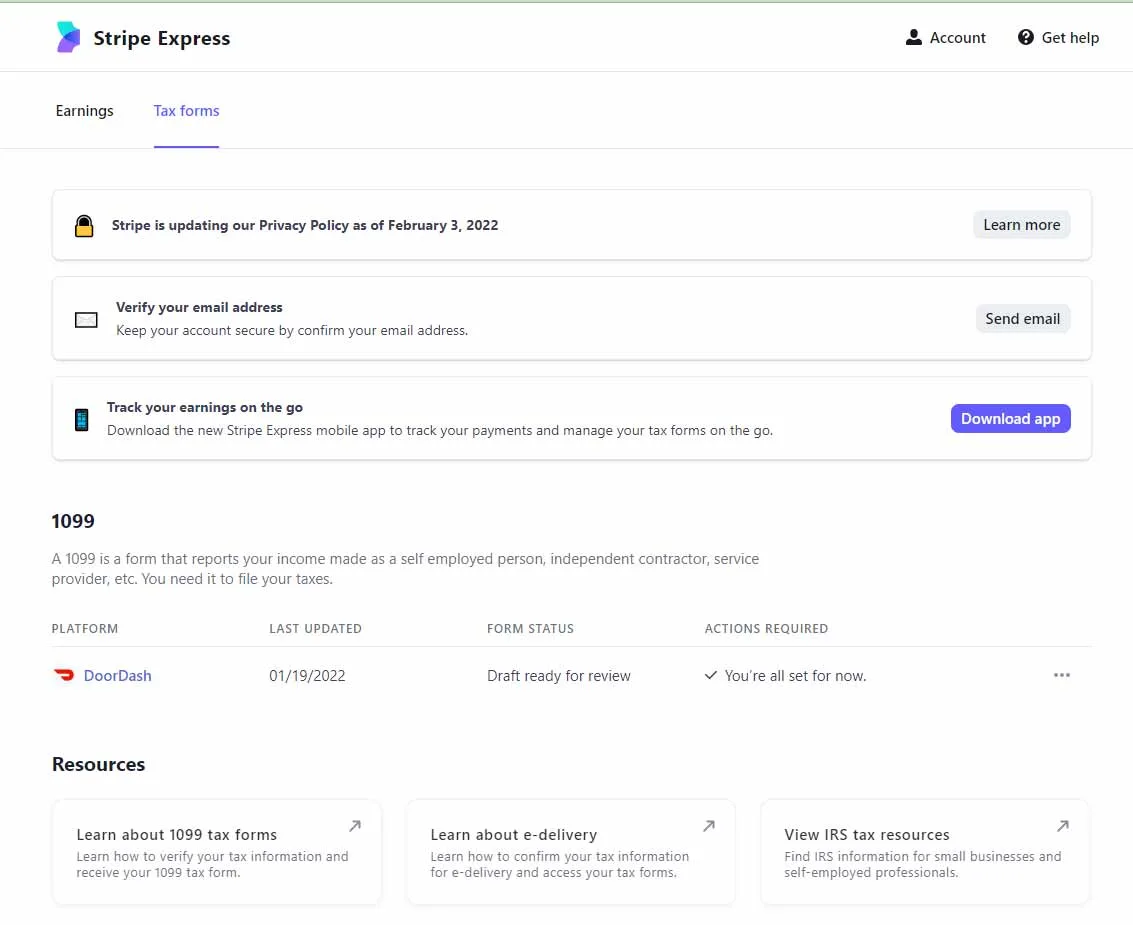

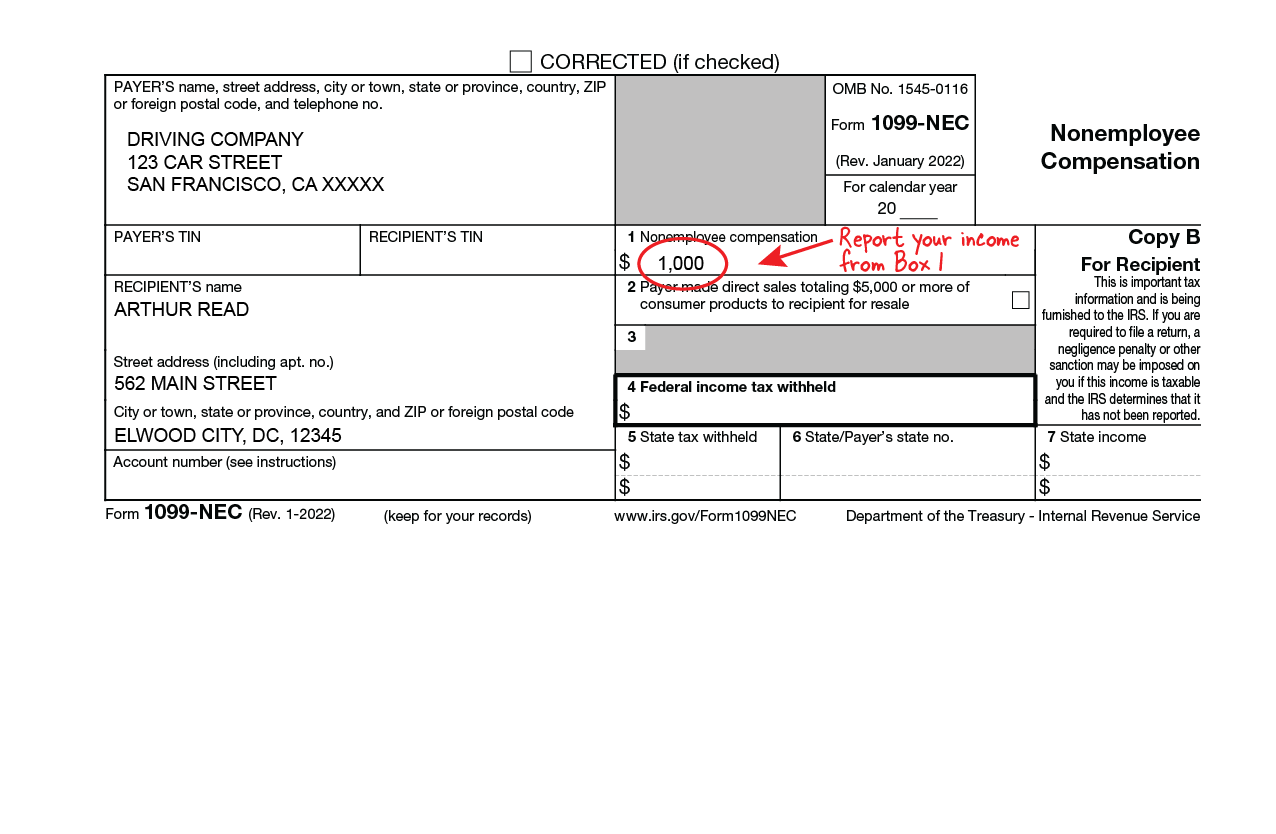

This reports your total Doordash earnings last year. Its provided to you and the IRS as well as some US states if you earn 600 or more in 2021.

Doordash Taxes Made Easy Ultimate Dasher S Guide Ageras

UPDATE Evening of July 9th.

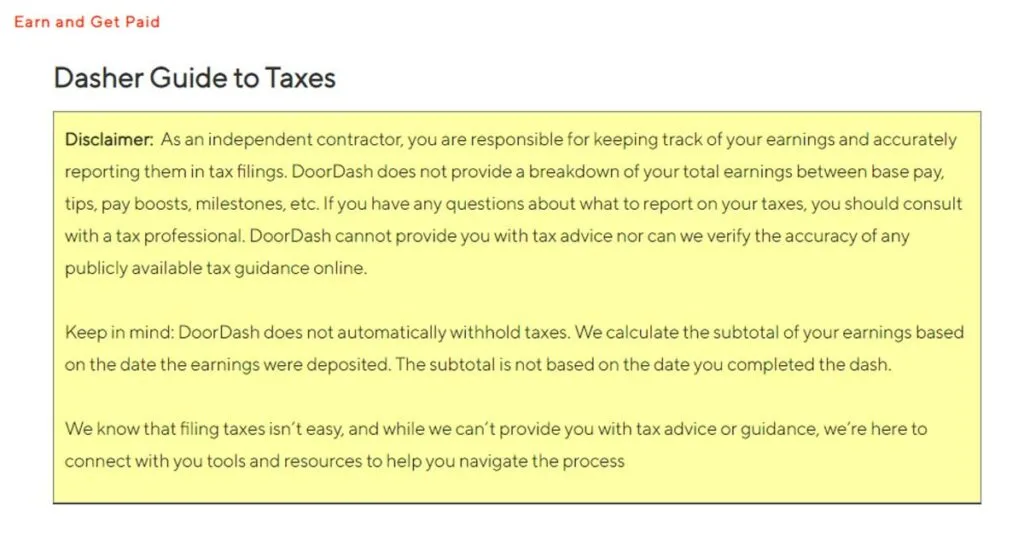

. If you didnât select a delivery method on your account DoorDash automatically mails and emails your 1099-NEC. 1099s and Delivery Drivers. Your FICA taxes cover Social Security and Medicare taxes 62 for Social Security and 145 for Medicare.

What is reported on the 1099-K. Form 1099-NEC reports income you received directly from DoorDash ex. Last year this information was reported on Form 1099-MISC box 7.

A former top dasher who paid off 78000 worth of student loans and is now a debt free engineer thanks to Doordashs customers and their low and high tips. FICA stands for Federal Income Insurance Contributions Act. Technically both employees and independent contractors are on the hook for these.

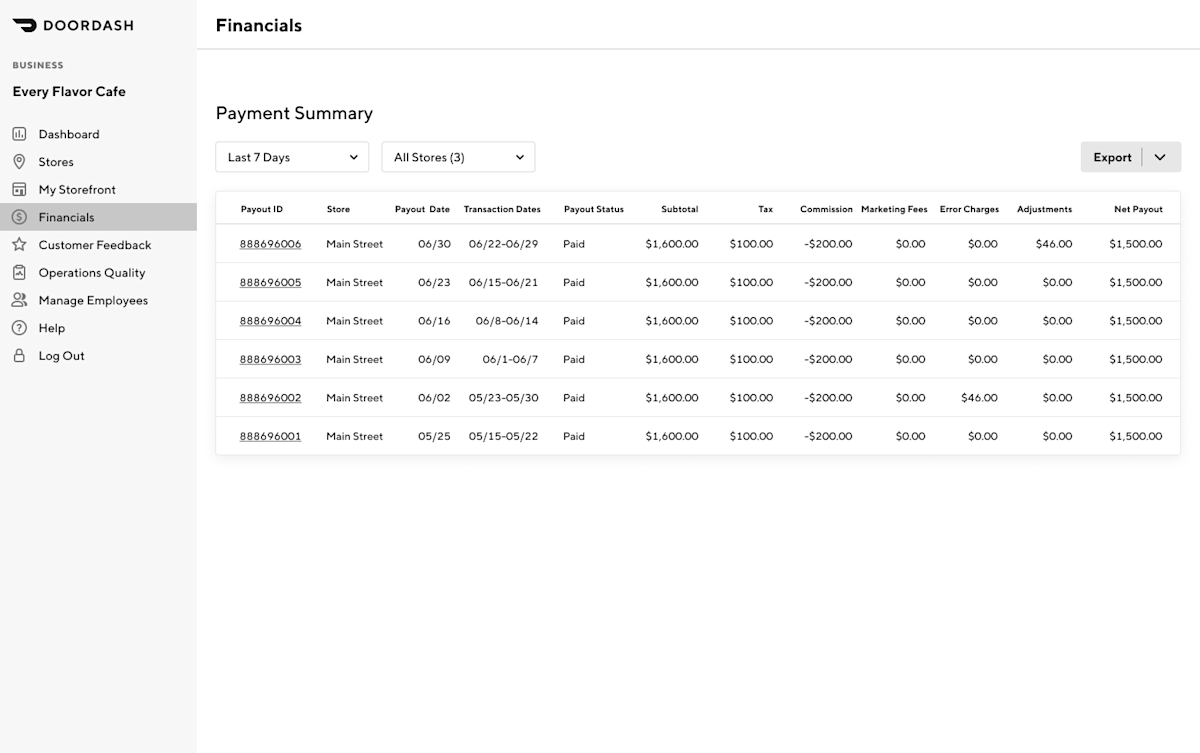

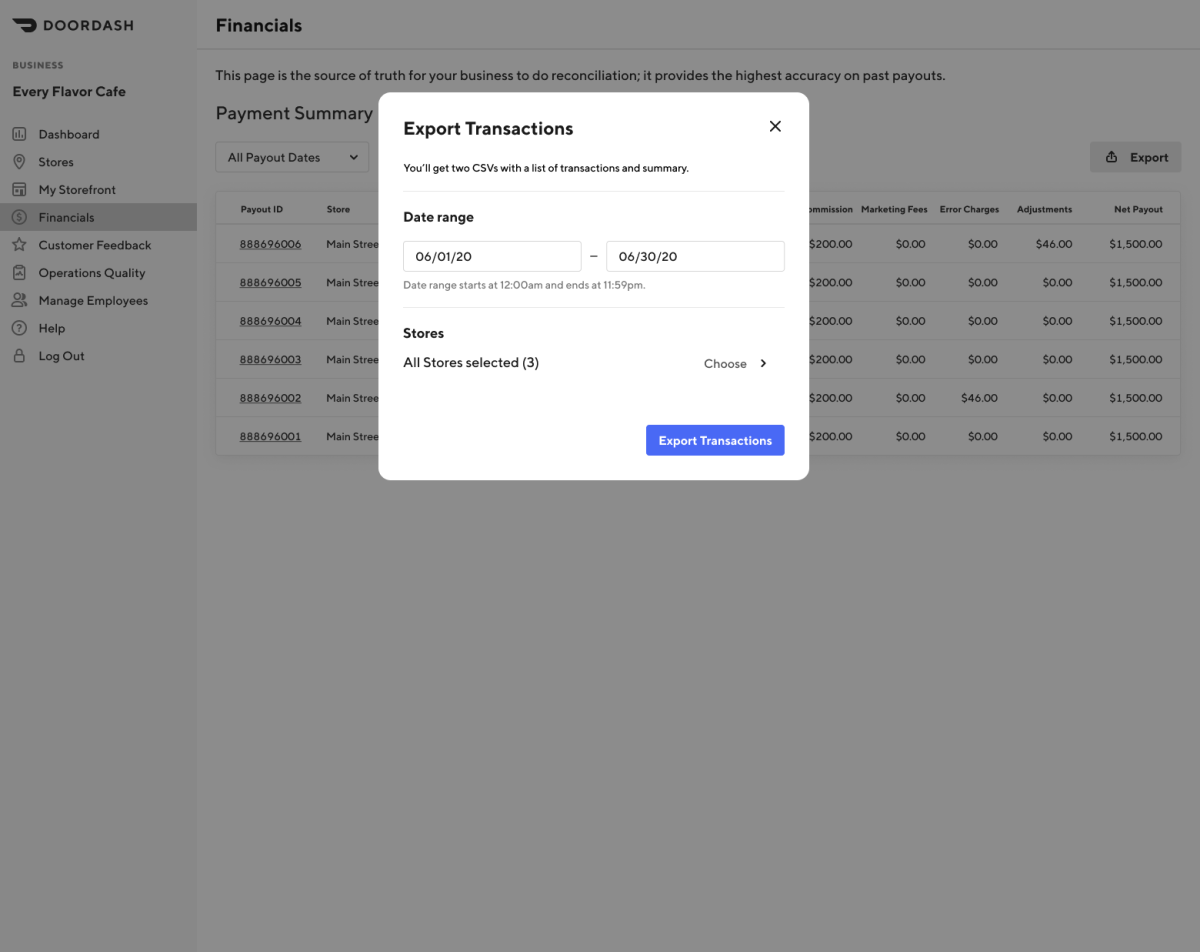

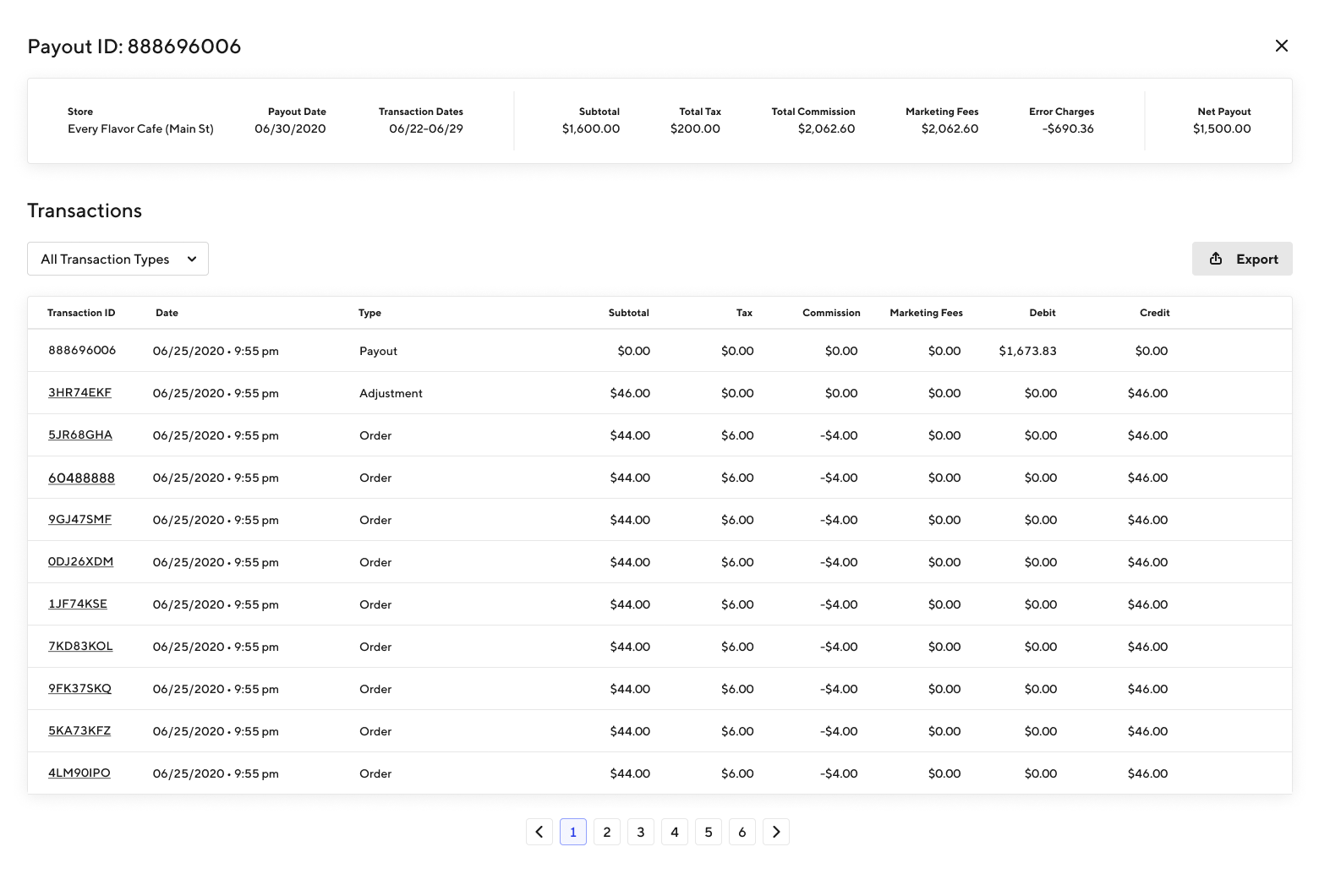

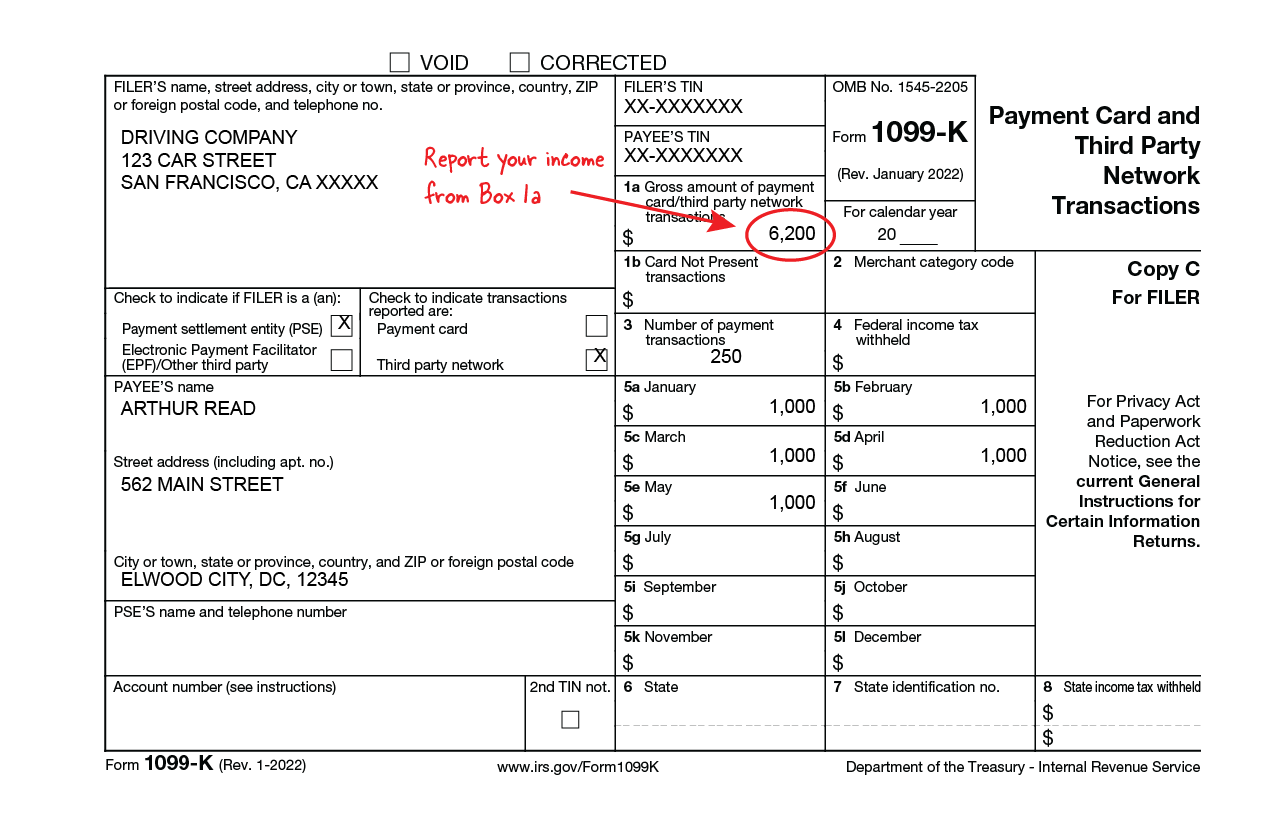

Per IRS guidelines Gross Volume processed via the TPSO which in DoorDashs case is the Subtotal and Tax on orders processed. What income do you have to report as a contractor with Grubhub Postmates Doordash Uber Eats etc DoorDash adds a new lobbying firm Biden meets with business and labor leaders Journals Julie Bykowicz and Brody Mullins report Yes you have to report any unemployment compensation you receive on your federal. This is the reported income a Dasher will use to file their taxes and what is used to file DoorDash taxes.

How does DoorDash report to IRS. Whether the payee vendor or contractor receives a 1099-K or not they are still required to report that income to the IRS and pay taxes accordingly. If you earn more than 600 in a calendar year youll get a 1099-NEC from Stripe.

DoorDash uses Stripe to process their payments and tax returns. Form 1099-NEC is new. Gross earnings from DoorDash will be listed on tax form 1099-NEC also just called a 1099 as nonemployee compensation.

Doordash will send you a 1099-NEC form to report income you made working with the company. While DoorDash doesnt send its drivers W-2 tax forms it does send them 1099-NEC forms and reports drivers income to the IRS. You will receive your 1099 form by the end of January.

Internal Revenue Service IRS and if required state tax departments. Because drivers will owe taxes from their profits from dashing a smart move would be to set aside about 30 percent of earnings in a bank account to prepare for paying taxes. Therefore the safe thing to do is always to follow the rules and report any income that you receive to avoid accusations of fraud repayments and penalties.

DoorDash uses Stripe to process their payments and tax returns. You do have the obligation to report any income to the IRS regardless of whether a 1099 was sent to you -- assuming you made at least 12550 total as a single taxpayer etc. 2 days ago.

You should report your total doordash earnings first. Whether the payee vendor or contractor receives a 1099-K or not they are still required to report that income to the IRS and pay taxes accordingly. Box 7 Nonemployee Compensation will be the most important box to fill out on this form.

In 2020 the IRS has mandated that DoorDash report Dasher income on the new Form 1099-NEC rather than the Form 1099-MISC. As such it looks a little different. The bill though is a lot steeper for independent contractors.

While DoorDash doesnt send its drivers W-2 tax forms it does send them 1099-NEC forms and reports drivers income to the IRS. I cant keep up the so many comments hah. A 1099 form differs from a W-2 which is the standard form issued to employees.

How does DoorDash report to IRS. A 1099-NEC form summarizes Dashers earnings as independent contractors in the US. Regardless of whether Doordash shares your income directly it will certainly be reported to the IRS eventually and your unemployment office will find out.

So DoorDash will send you a 1099-MISC but then you need to self report your expenses like mileage on a Schedule C they basically subtract what you made with DD from your UI for that week Everything jobless Americans need to know about the 300 unemployment benefit So mainly from Doordash Does Not Vet their Delivery People and Wont Cooperate. They have no obligation to report your earnings of. These items can be reported on Schedule C.

Incentive payments and driver referral payments. Stripe also sends 1099-Ks for other companies or payments but the way theyre set up with DoorDash means DoorDash work will go on a 1099-NEC for DoorDash. The forms are filed with the US.

If youre a Dasher youll need this form to file your taxes. Tough to decipher the exact question youre asking but. You will be provided with a 1099-NEC form by Doordash once you start working with them.

Because drivers will owe taxes from their profits from dashing a smart move would be to set aside about 30 percent of earnings in a bank account to prepare for paying taxes.

Common 1099 Problems And How To Fix Them Doordash Uber Eats Grubhub 2021 Entrecourier

Common 1099 Problems And How To Fix Them Doordash Uber Eats Grubhub 2021 Entrecourier

A Beginner S Guide To Filing Doordash Taxes 4 Steps

Doordash 1099 Critical Doordash Tax Information For 2022

Doordash Taxes 13 Faqs 1099 S And Income For Dashers

How Do Food Delivery Couriers Pay Taxes Get It Back

Reporting Income On Taxes 2021 Doordash Uber Eats Grubhub Instacart

Santander Collections Reported Cfpb Complaint How To Diy Credit Repair Dispute Letters Tutorial Credit Repair Lettering Tutorial Dispute Credit Report

Deliver Your 1099 Tax Forms Stripe Documentation

Prepare For Tax Season With These Restaurant Tax Tips

Reporting Income On Taxes 2021 Doordash Uber Eats Grubhub Instacart

How Do Food Delivery Couriers Pay Taxes Get It Back

Doordash 1099 Critical Doordash Tax Information For 2022

How Do Food Delivery Couriers Pay Taxes Get It Back

Doordash 1099 Taxes Your Guide To Forms Write Offs And More

Doordash 1099 Critical Doordash Tax Information For 2022

Is Your Insurance Covering You While You Deliver For Doordash Most Personal Policies Exclude Delivery Work Meaning They Won Doordash Car Insurance Insurance